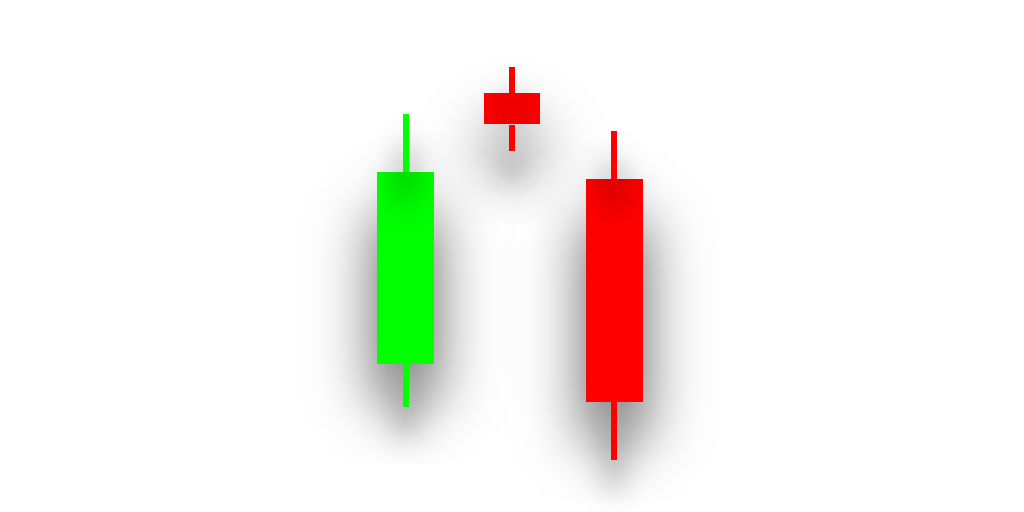

The evening star is a bearish reversal pattern that is commonly used in technical analysis to signal a potential reversal in an uptrend. The pattern consists of three candlesticks that suggest that the bulls are losing control of the market, and that the bears are starting to gain momentum.

The first candle in the pattern is a long bullish candlestick that reflects the existing uptrend. The second candle is a small-bodied candlestick that may be bullish or bearish and gaps up from the previous candle. This candle is called the "star" and represents a moment of indecision in the market. The third candle is a long bearish candlestick that closes below the midpoint of the first candle.

Beginner traders can use the evening star pattern to identify a potential reversal in an uptrend. When the pattern appears, it is a signal that the buying pressure is subsiding, and that sellers may be gaining control of the market. However, it is important to confirm the pattern with other technical analysis tools before making a trade.

To confirm the evening star pattern, traders can look for other bearish signals such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators. The RSI measures the strength of a stock's price action, and a reading below 50 indicates bearish momentum. The MACD is a trend-following momentum indicator that can confirm a trend reversal when the MACD line crosses below the signal line.

Intermediate traders can use the evening star pattern in combination with other technical analysis tools to create a trading strategy. For example, traders can use the pattern to identify potential entry and exit points, as well as support and resistance levels. When the pattern appears near a resistance level, it can be a signal to sell the stock. Similarly, when the pattern appears near a support level, it can be a sign to buy the stock.

Advanced traders can use the evening star pattern as part of a comprehensive trading system. They can combine the pattern with other technical analysis tools, such as Fibonacci retracements, to identify potential price targets. By using the evening star pattern in conjunction with Fibonacci retracements, traders can identify potential price targets for a bearish trend continuation.

In conclusion, the evening star pattern is a reliable pattern used in technical analysis to signal a potential bearish trend reversal. It is a three-candlestick pattern that suggests that the bears are gaining control of the market and that the bullish trend is likely to reverse. Beginner traders can use the pattern as a basic signal to identify a potential reversal, while intermediate and advanced traders can use it in combination with other technical analysis tools to create a trading strategy or a comprehensive trading system. However, it is important to confirm the pattern with other technical analysis tools and to practice risk management to minimize losses.