Candlestick charts are a popular tool for traders to analyze financial markets. Bearish regular candlestick patterns are an important component of candlestick charting. These patterns provide valuable information about the market sentiment, particularly when traders are bearish on the market. In this article, we will cover what a bearish regular candlestick is, how to identify it, and what it indicates for traders.

What is a Bearish Regular Candlestick?

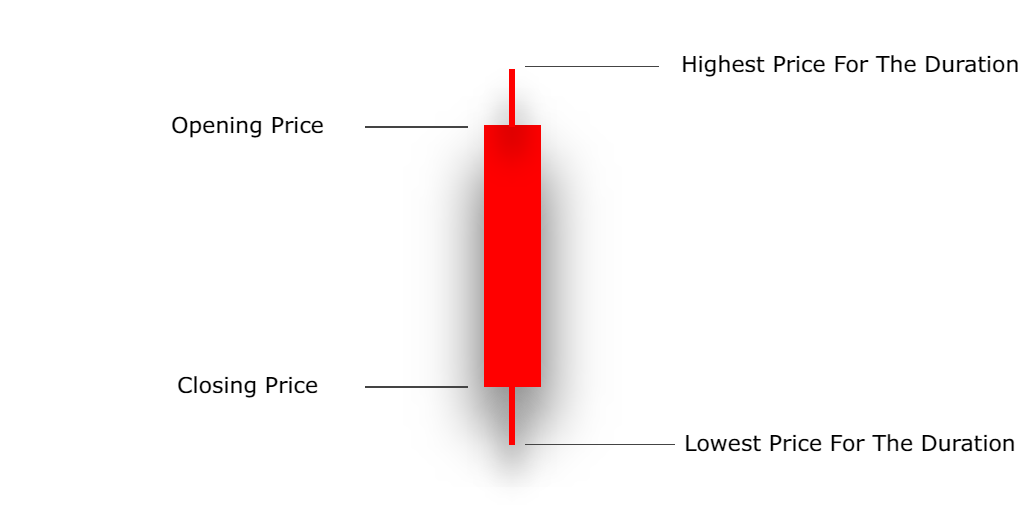

A bearish regular candlestick is a candlestick pattern that forms when the closing price is lower than the opening price, indicating a bearish sentiment in the market. The body of the candlestick is usually colored red or black, while the shadows (upper and lower wicks) are relatively small compared to the body.

How to Identify a Bearish Regular Candlestick?

To identify a bearish regular candlestick, you need to look for the following characteristics:

-

The closing price of the candlestick must be lower than the opening price.

-

The body of the candlestick must be relatively long, indicating a strong bearish sentiment.

-

The shadows (upper and lower wicks) must be relatively small compared to the body.

What does a Bearish Regular Candlestick indicate for Traders?

A bearish regular candlestick indicates that the sellers are in control of the market, and there is a high probability of a bearish trend. Traders who are bearish on the market may use this pattern as an indication to sell or short their positions.

However, it is important to note that a bearish regular candlestick is not a guarantee of a bearish trend. Traders should always use other technical indicators and fundamental analysis to confirm the trend before making a trading decision.

Conclusion

Bearish regular candlestick patterns can be a powerful tool for identifying potential bearish trends in the market. Traders who are new to candlestick charting should take the time to learn how to identify this pattern and use it in conjunction with other technical indicators and fundamental analysis to make informed trading decisions. With practice, traders can use bearish regular candlesticks to improve their trading strategies and achieve greater success in the financial markets.