Inverted hammer candlesticks are a popular candlestick pattern in technical analysis. They are a bullish reversal pattern that can provide traders with valuable information about the market sentiment. In this article, we will cover what an inverted hammer candlestick is, how to identify it, and what it indicates for traders.

What is an Inverted Hammer Candlestick?

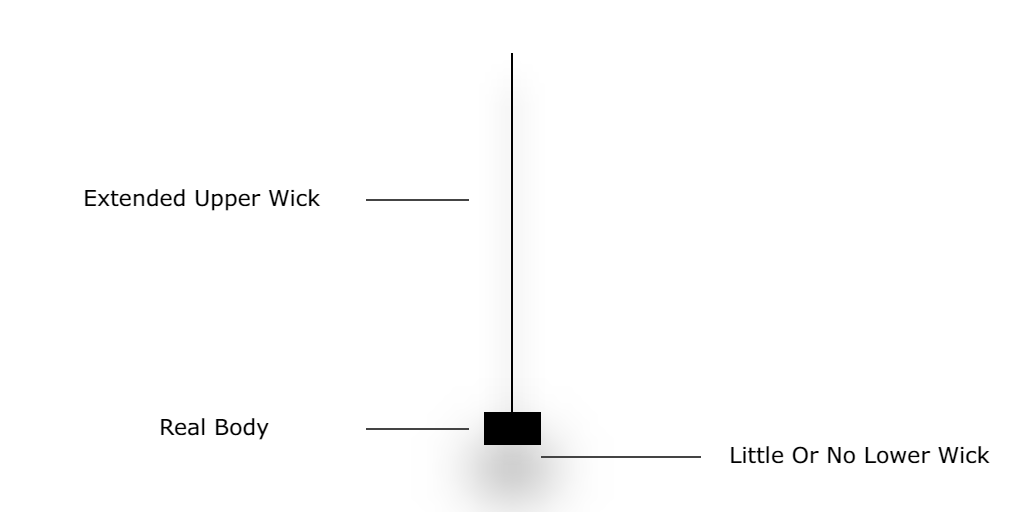

An inverted hammer candlestick is a bullish reversal pattern that forms at the end of a downtrend. The candlestick has a long upper shadow, a small real body, and little or no lower shadow. The shape of the candlestick resembles an inverted hammer, hence the name "inverted hammer candlestick."

The inverted hammer candlestick pattern is created when the market opens near its high, sells off during the trading session, but then rallies to close near its opening price. This price action shows that buyers were able to overcome sellers, and there is a shift in market sentiment from bearish to bullish.

How to Identify an Inverted Hammer Candlestick?

To identify an inverted hammer candlestick, you need to look for the following characteristics:

-

The candlestick has a long upper shadow, which should be at least twice the length of the real body.

-

The real body is small, indicating that the opening and closing prices were close to each other.

-

There is little or no lower shadow, indicating that the buyers were able to push the price up before the close.

What does an Inverted Hammer Candlestick indicate for Traders?

An inverted hammer candlestick indicates a potential bullish reversal in the market. The long upper shadow suggests that sellers were able to push the price down, but buyers stepped in and drove the price back up. The small real body indicates that the buyers were able to push the price up, but there is still some selling pressure in the market.

Traders who see an inverted hammer candlestick may use it as an indication to buy or go long, depending on their trading strategy. However, it is important to note that traders should not rely solely on this pattern and should use other technical indicators and fundamental analysis to confirm the trend before making a trading decision.

Conclusion

It is worth noting that although the inverted hammer candlestick is a bullish reversal pattern, it is not a guarantee that the market will continue to move upward. Traders should always keep in mind that the market can be unpredictable and that technical analysis is only one tool in a trader's toolkit.

When using the inverted hammer candlestick as part of their trading strategy, traders should also pay attention to the volume of the trading session in which the pattern formed. Higher trading volume can provide confirmation of the reversal pattern and increase the likelihood of a successful trade.

In addition, traders should be aware of the importance of risk management when trading. Setting stop-loss orders and having a clear understanding of their risk tolerance can help traders minimize their losses and maximize their gains.

In conclusion, the inverted hammer candlestick is a valuable tool for traders in technical analysis. It can provide valuable information about the market sentiment and indicate a potential change in trend from bearish to bullish. Traders who are new to candlestick charting should take the time to learn how to identify this pattern and use it in conjunction with other technical indicators and fundamental analysis to make informed trading decisions. With practice, traders can use inverted hammer candlesticks to improve their trading strategies and achieve greater success in the financial markets.